south carolina inheritance tax rate

South Carolina laws preserve the inheritance rights to at least a part of an estate for a surviving spouse even in such cases. There are seven states that assess an inheritance tax so make sure to ask your accountant if you think you may be subject to it.

South Carolina Income Tax Calculator Smartasset

Does South Carolina Have an Inheritance Tax or Estate Tax.

. The top inheritance tax rate is 15 percent no exemption threshold Rhode Island. Does South Carolina impose a state death tax on estates of decedents similar to the federal Estate Tax. Make sure to check local laws if youre inheriting something from someone who lives out of state.

Maryland is the only state to impose both. Counties in South Carolina collect an average of 05 of a propertys assesed fair market value as property tax per year. No estate tax or inheritance tax.

Keep reading for all the most recent estate and inheritance tax rates by state. No estate tax or inheritance tax. But if you live in South Carolina and you receive an inheritance from another estate you could be subject to inheritance tax in that state.

And personal property is taxed at 105 of income tax depreciated value. South Carolina taxes gains on investments held for longer than one year at a rate shown in the tables above. The top estate tax rate is 16 percent exemption threshold.

The median property tax in South Carolina is 68900 per year for a home worth the median value of 13750000. You pay inheritance tax as part of your. No estate tax or inheritance tax.

7 percent on taxable income of 14861 and above. April 14 2021 by clickgiant. South Carolina tax returns are.

However for decedents dying in 2014 a Form 706 must be filed if the total estate value for federal tax purposes called the gross estate which is the total value of the decedents assets located in South Carolina and elsewhere exceeds 5340000. Not all estates must file a federal estate tax return Form 706. Does South Carolina Have an Inheritance Tax or Estate Tax.

Your federal taxable income is the starting point in determining your state income tax liability. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. There is no inheritance tax in South Carolina.

Estate planning in South Carolina Once you own a sufficient property that exceeds the 1206 million federal estate tax exemption bar you may want to reduce the taxable part of your estate to preserve your heirs. Got It A Guide to South Carolina Inheritance Laws Rachel CauteroFeb 21 2020 Share South Carolina does not levy an inheritance or estate tax but like all states it has its own unique set of laws regarding inheritance of estates. Individual income tax rates range from 0 to a top rate of 7 on taxable income.

Primary residences in South Carolina are taxed at a rate of 4 their value. No estate tax or inheritance tax. A federal estate tax ranging from 18 to 40.

The top estate tax rate is 16 percent exemption threshold. No estate tax or inheritance tax. No estate tax or inheritance tax.

No estate tax or inheritance tax. 6 percent on taxable income between 11881 and 14860. However the federal government still collects these taxes and you must pay them if you are liable.

Property taxes are paid directly to South Carolina Department of Revenue. Twelve states and Washington DC. Agricultural property is taxed at 4 its use value.

However the state does have its own inheritance laws that govern which beneficiaries will receive portions of an estate after a loved one dies. Tax brackets are adjusted annually for. Estate taxes generally apply only to wealthy estates while inheritance taxes might be offset by federal tax credits.

Railcar companies are also subject to property taxes in South Carolina as well as utility companies. South Carolina Inheritance Tax and Gift Tax. The South Carolina income tax has six tax brackets with a maximum marginal income tax of 700 as of 2022.

South Carolina accepts the adjustments exemptions and deductions allowed on your federal tax return with few modifications. However if you are the recipient of an inheritance from an individual who. It is one of the 38 states that does not have either inheritance or estate tax.

No estate tax or inheritance tax. Yes on-premises sales only 10. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

However the Palmetto States income tax is between 0 and 7 the 13th-highest in the country. Tax rate Does general sales tax apply. It is one of the 38 states that does not have either inheritance or estate tax.

No estate tax or inheritance tax. Impose estate taxes and six impose inheritance taxes. South Carolina does not assess an inheritance tax nor does it impose a gift tax.

South Carolina has one of the lowest median property tax rates in the United States. 1 In 17 states the government directly controls the sales of distilled spirits. Aiken South Carolinas incredible cost of living is another key factor to consider when determining your retirement.

5 percent on taxable income between 8911 and 11880. Tax amount varies by county. A 5 excise tax is imposed on motor vehicles in the state.

However these gains currently have a 44 exemption. For full annotations see the source below. There are no inheritance or estate taxes in South Carolina.

South Carolina does not tax inheritance gains and eliminated its estate tax in 2005. South Carolina is one of 38 states that does not levy an estate or inheritance tax on beneficiaries after a loved one has passed away. For instance in Kentucky all in-state property is subject to the inheritance tax even if the person inheriting it lives out of state.

What is the estate tax rate in South Carolina. Detailed South Carolina state income. South Carolina has no Estate Tax for decedents dying on or after January 1 2005.

South Carolina Estate Tax. South Carolina also has no gift tax. The top inheritance tax rate is 15 percent no exemption threshold Rhode Island.

There are no inheritance or estate taxes in South Carolina. South Carolina does not have an estate or inheritance tax. There is no estate tax in South Carolina for individuals who passed away on or after January 1 2005.

The Ultimate Guide To South Carolina Real Estate Taxes

Real Estate Property Tax Data Charleston County Economic Development

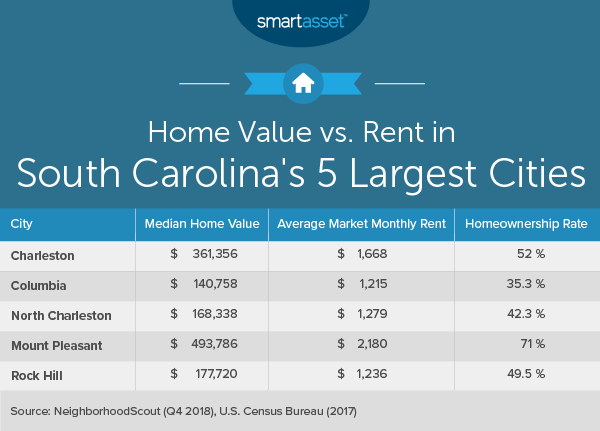

Cost Of Living In South Carolina Smartasset

South Carolina Vs North Carolina Which Is The Better State Of The Carolinas

North Carolina Tax Reform North Carolina Tax Competitiveness

South Carolina Retirement Tax Friendliness Smartasset

South Carolina Inheritance Laws King Law

South Carolina Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

South Carolina Estate Tax Everything You Need To Know Smartasset

South Carolina Inheritance Laws What You Should Know Smartasset

Thinking About Moving These States Have The Lowest Property Taxes

South Carolina Estate Tax Everything You Need To Know Smartasset

Ultimate Guide To Understanding South Carolina Property Taxes

State Corporate Income Tax Rates And Brackets Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation